(*Disclaimer to start. This is of course a very fluid situation and these experts put these opinions out around the 20th of March. Since then, there has been an extended “stay home” order until May 6th. I predict that will impact the bottom line numbers, but it remains to be seen how the stimulus package will help as of yet. I will update as the market changes).

First things first…. I hope everyone is staying home as much as possible, staying healthy and practicing social distancing. The health of my friends and neighbors is what is most important!

If you have any questions about the Coronavirus and what steps can be taken to mitigate risks, go HERE

While health and stability are of UTMOST importance, the economy is also something that greatly impacts all of us. Real Estate is of course, a HUGE part of the economy. It also happens to be most people’s largest financial investment. With that being said, I have been studying and gathering as much information as possible in regards to how this Covid-19 virus (plus our governments reaction to it) will impact the housing market. The following graphs will demonstrate what many experts think will happen to the housing market, and more importantly give reasons as to why they came to their conclusions.

This assessment by Lawrence Yun is Reason number one, why those of us who who had concerns about there possibly being a repeat of the Recession from 2008, may well be unfounded.

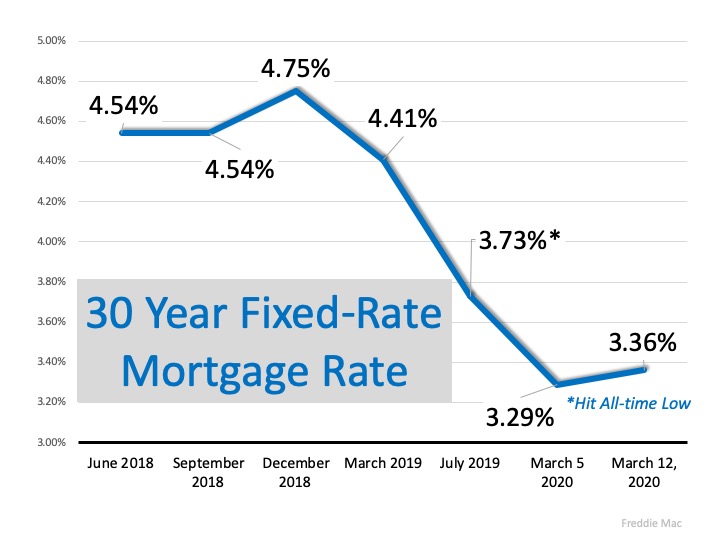

Interest Rates have remained at historically low levels. This ensures more people will continue to be in the home buying market.

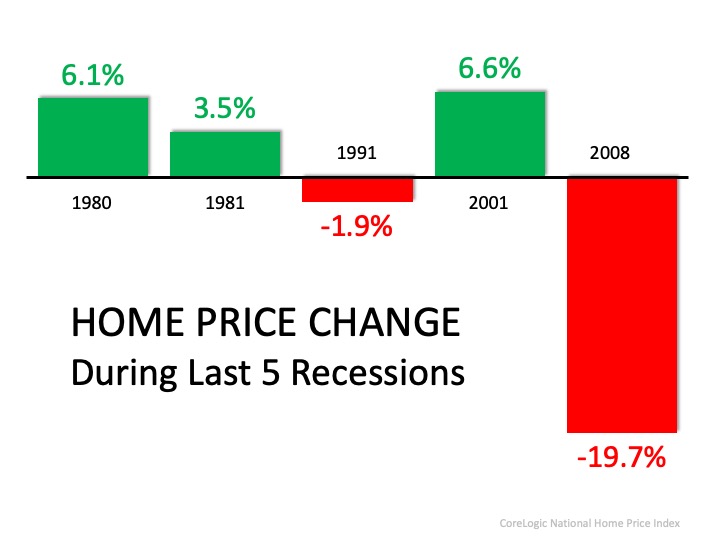

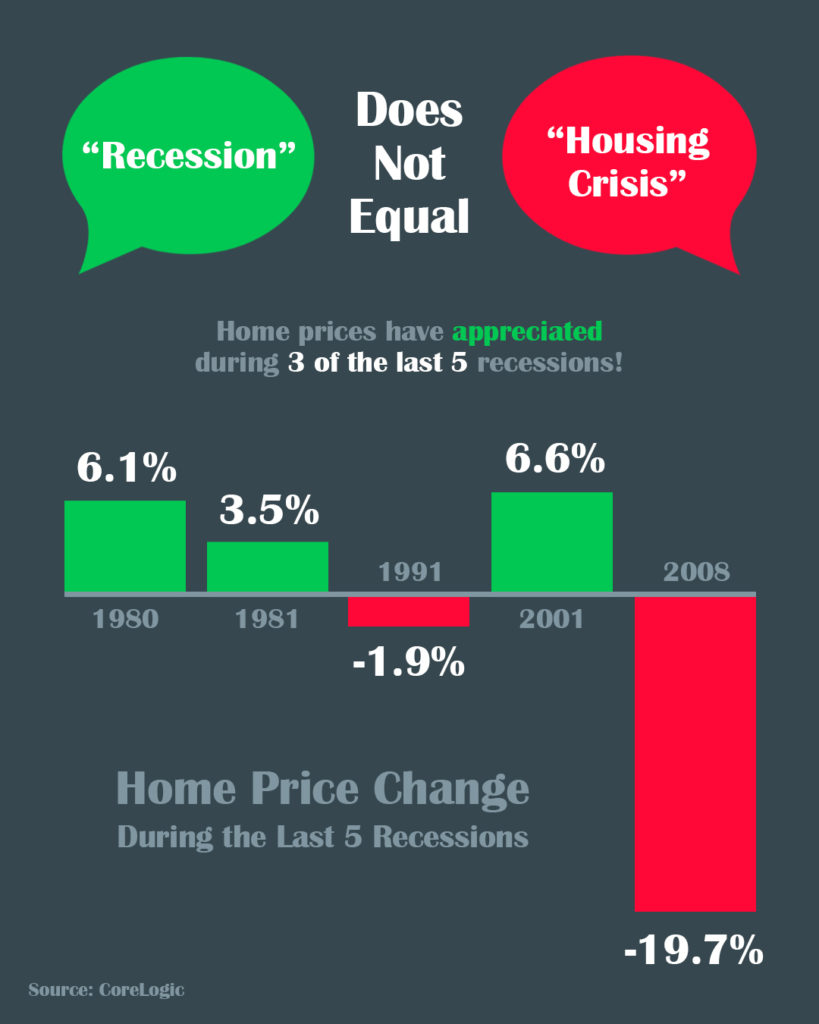

As you can see by this graph from the experts at CoreLogic, the Recessions in the past have not yielded dramatic home value losses (with the unique exception of 2008). As stated above, our market is not in the same circumstance as it was then.

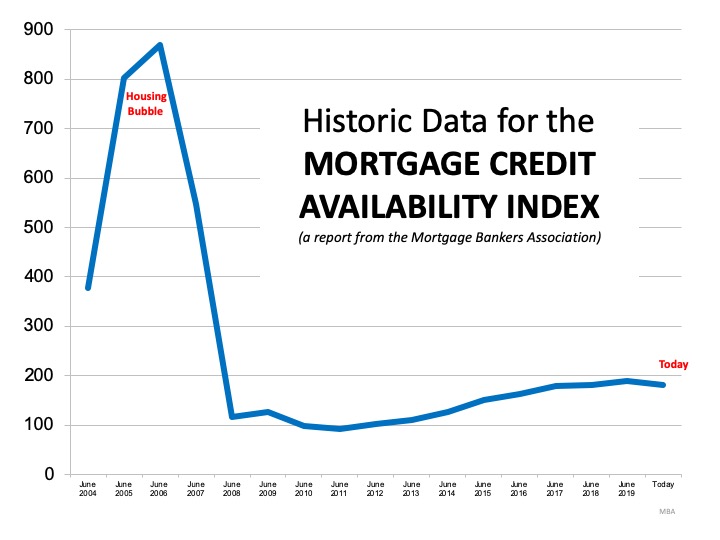

This graph may just be the most important of all. The Mortgage Credit Availability Index is almost opposite of how to read an individual’s credit score. This is explained HERE

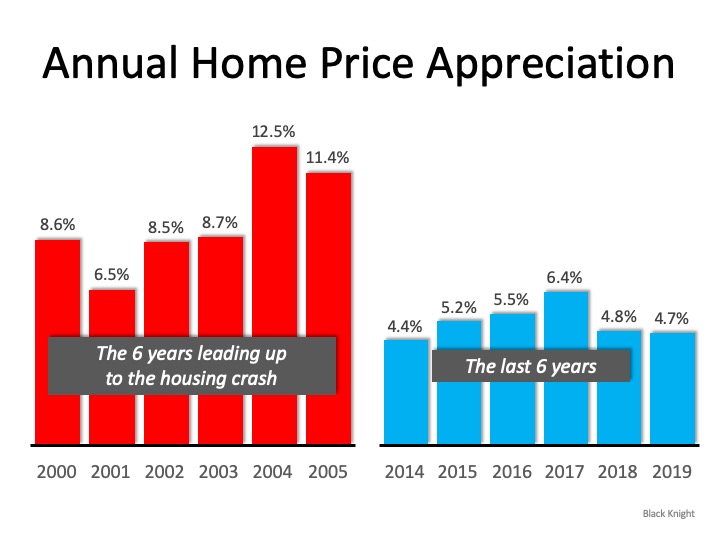

Unlike the housing bubble of 2008, where sub-prime lending was rampant and home value appreciation/speculation was unsustainable, our natural value increase over the last SIX years means that people are most likely not “upside down” on their mortgages. If forced to sell because of the economy, the value and equity will combine with the housing shortage to keep most people out of foreclosure. Very different than 2008.

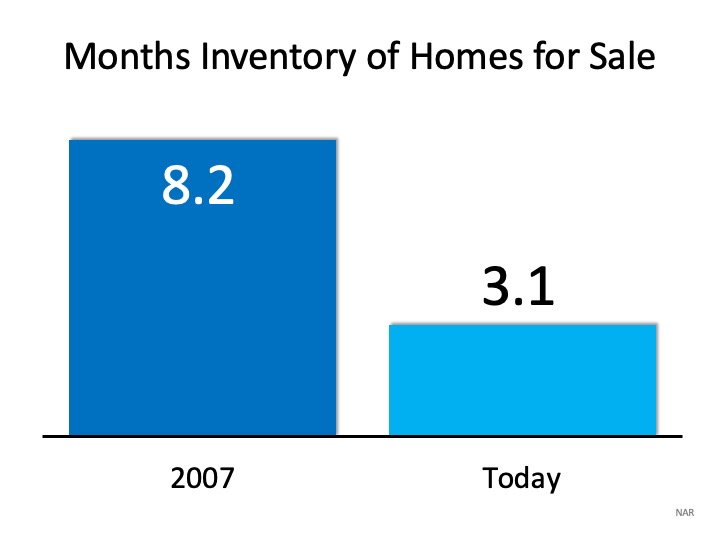

Another huge difference between today’s uncertain time and the housing bubble of 2008 is the “Months of Inventory” we have. According to the NAR, a normal/healthy market is around 5 months of inventory. Our 3.1 months combined with low interest rates will keep buyers in the market.

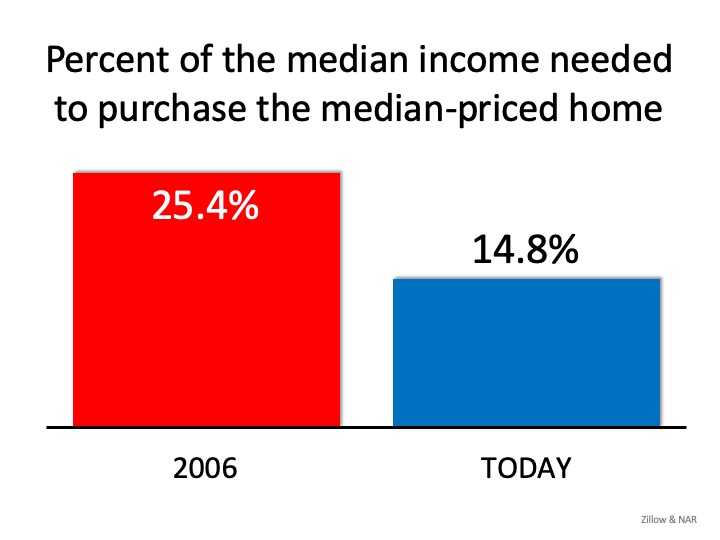

Nationally, we are in a much better place collectively than we were in 2006 with regards to how much of our income is set aside for home costs. *Zillow and NAR. I think this is a bit inaccurate for our local market, but if there was going to be a big housing problem, it would be initiated nationally.

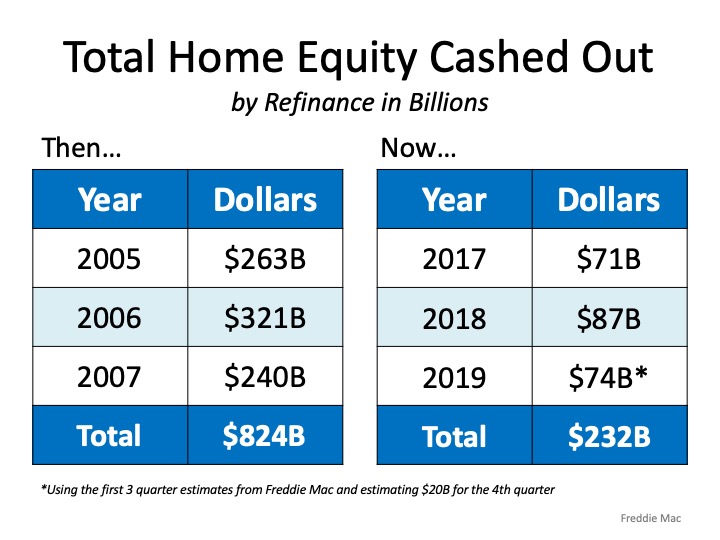

One of the important lessons learned from the 2008 housing crash! As Americans, we were using our homes as literal “piggy banks”. If there was equity in the home, people used it for vacations, new cars, boats and other non-essential items. Once the market started to correct itself, there was NO equity left for the sellers to absorb even the smallest downturn in prices. That started the wave of foreclosures. We are in a MUCH BETTER position now.

Just to reiterate the point that the housing experts from CoreLogic, NAR, Zillow and the Mortgage Industry made, they emphasized the fact that if there is a Recession (a contraction of the GDP for six months) that doesn’t mean there will be a housing crisis. There are/were several factors that took place in 2008 that are not happening today. The banking industry has changed dramatically (housing credit avail index), home owners have learned a lesson and have lines of credit/Helocs at less than a 1/3 of what they did in 2006. This gives them much more equity to absorb a slight down tick of prices should that occur. Slower, more even home value appreciation for the last six years, and only a 3 month supply of homes buffers most people in this strange market.

——————————————————————————————————————————————————————————–

With regards as to how the Bellingham, Wa. & the rest of Whatcom County is doing so far, there appears to be no noticeable slow down. Here is a snapshot of the last 7 days for Residential (single family and condo) transactions.

So. What does this mean for home owners in Washington State? Currently, the market seems to be stable. It will be interesting to see what happens in the next few weeks as we move forward with the Governor’s “Stay Home, Stay Safe” order.

The most important thing to remember is to stay safe and stay healthy. That is Goal #1.

I know that I want to do everything possible to give my customers the latest data so they can make an informed decision on what they want to do next. I am here to answer any questions you may have, and will keep you updated on the market as we progress.

I agree 100%. While my job is to help facilitate home sales and purchases, I am also reminded that we are all in this together. We depend on each other to do our part to help our country get back to normal.

————————————————————————————————————————————————————————–

If you find yourself curious about your homes worth as we go forward, don’t hesitate to contact me. You can easily hit the “What’s my Home value” button on the right side of this page. We are also implementing virtual showings for homes you may be interested in. Sign up for free email alerts for homes that match your desired criteria to be sent directly to your inbox! When you see one you like, and want more than just the pictures provided, I take videos of my walk through and send them to you to see if you want to see it in person. That way, you stay safe at home until the right property comes along. As you can see by the activity graph above, there are savvy buyers and sellers taking advantage of the market changes.

If you are looking for more info on Government programs designed to help people if they need mortgage relief, click HERE

I look forward to answering all your real estate questions! Feel free to contact me at any time!

Leave a Reply