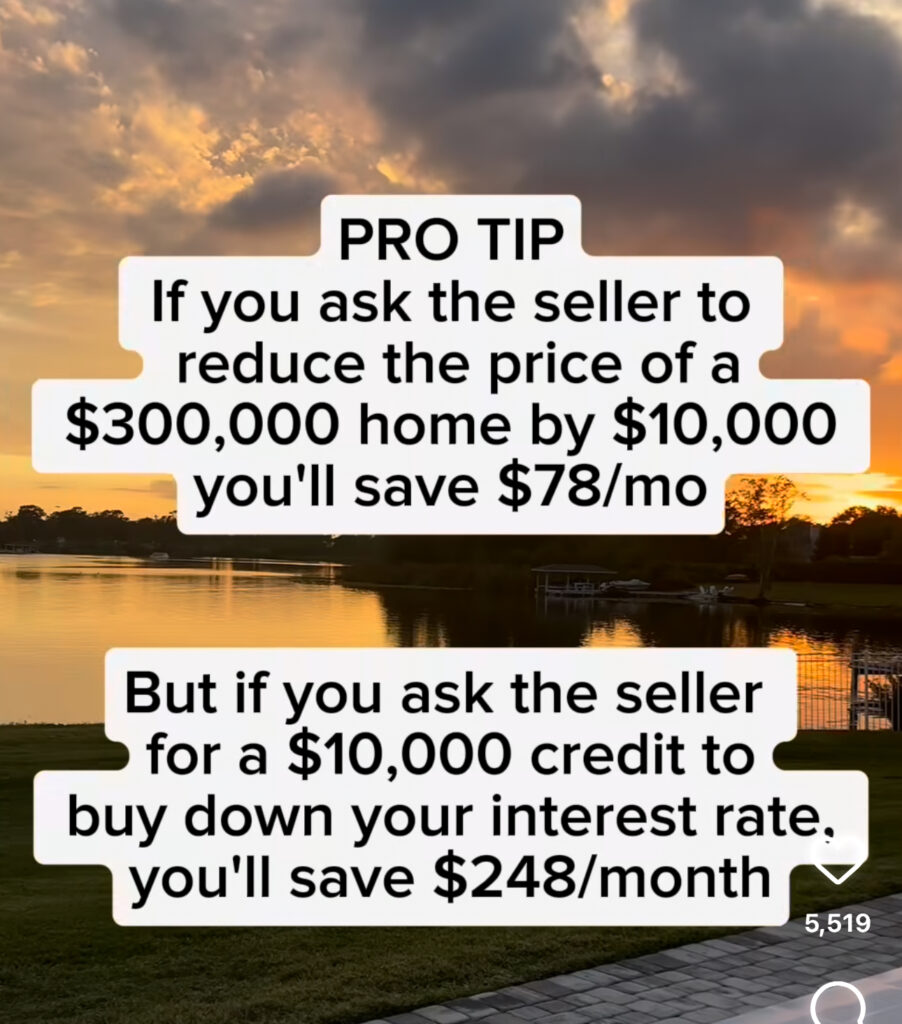

As explained by Money.com, here is a quick example of how a “buy down” may work (it may be negotiated to be paid by the home seller as well!).

Mortgage buydown options

Setting permanent buydowns and discount points aside for a moment, the following section examines the different types of buydowns offered by lenders, builders and sellers. These options include 1-0 buydowns, 2-1 buydowns and 3-2-1 buydowns. Each buydown mortgage varies regarding how much they reduce the loan’s interest rate and for how long.

1-0 buydown

A 1-0 buydown is the simplest type of mortgage rate buydown. It involves reducing the loan’s interest rate by 1% for the first year of the loan term before the loan reverts to its original, higher rate.

2-1 buydown

A 2-1 buydown mortgage means the interest rate is reduced by 2% in the first year and 1% in the second year, then increases to the original interest rate for the remainder of the loan term. This type of buydown can provide substantial savings in the early years of the mortgage while allowing borrowers to budget for future adjustments.

3-2-1 buydown

The 3-2-1 buydown reduces the interest rate by 3% in the first year, 2% in the second year, and 1% in the third year, after which it increases to the original rate offered. This option is ideal for borrowers who expect a steady increase in their income over the initial years of homeownership.

Ask me for more information on this interesting concept, and for some great lenders who will help walk you through the process.

Leave a Reply