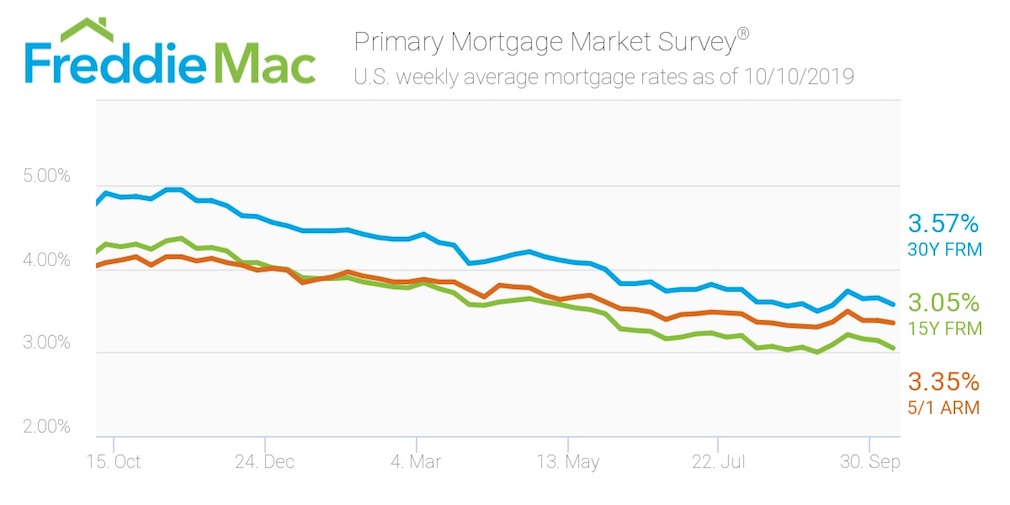

Great News this week, the average U.S. fixed rate for a 30-year mortgage declined to 3.57%. That’s 8 points below last week’s 3.65% and more than a percentage point lower than the 4.71% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“The fifty-year low in the unemployment rate combined with low mortgage rates has led to increased homebuyer demand this year,” Khater said. “Much of this strength is coming from entry-level buyers – the first-time homebuyer share of the loans Freddie Mac purchased in 2019 is 46%, a two-decade high.”

The 15-year FRM averaged 3.05% this week, dropping from last week’s 3.14%. This time last year, the 15-year FRM came in at 4.29%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.35%, moderately falling from last week’s rate of 3.38%. Once again, the percentage is still a significant decrease from 2018’s rate of 4.07%.

Now is a GREAT time to BUY or Sell real estate. With super low interest rates and now low inventory, now is the time!

Sign up for free email alerts for new listings to be sent to your inbox as soon as they hit the market so you will never miss your dream home!

Leave a Reply